Today, I would like to explain how accounts payable is handled in SAP FI.

Accounts payable is one of liability for company to pay money for inventory purchased or serviced rendered by third party.

Accounts payable is a record that is captured by vendor, who provided its product or service, so let me start with explanation of vendor master record.

Agenda

Vendor Master

Basic Structure

Again, accounts payable is closely related to Vendor Master, because the accounts payable is created for transaction to recognize liability to pay money for the vendor in the future.

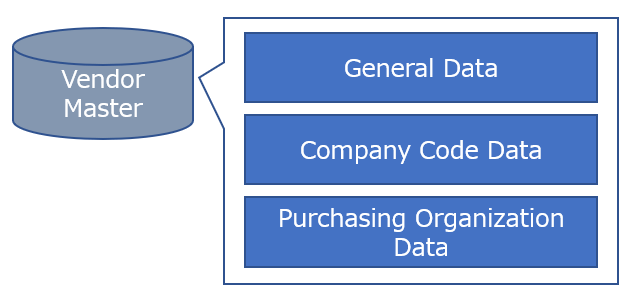

Vendor account is made up of 3 data, which are general data, company code specific data, and purchasing organization data.

General data is common information for all the company codes, such as the vendor's name and addresses.

Company code specific data is an information which is related only to the relevant company code, such as agreed payment conditions or reconciliation account. Until the company specific data is registered in SAP, the financial transaction for the vendor is not possible.

In purchasing organization data, further detailed information such as incoterms requirement for purchasing transaction, or something are maintained.

When you use Tr-code: XK03, vendor master can be displayed. SAP asks you to input Vendor code, Company code, and Purchase Organization if you need to see all the views. If you only want to check general data, you have to input only Vendor code.

In S/4 HANA, instead of vendor master, BP (business partner) master is used, as an integrated master of vendor and customer. Tr-Code: XK03 is still usable, but when you hit the enter button to proceed to next screen, the screen would be automatically switched to those used in BP.

To see the vendor master through BP functionality, you need to enter Tr-Code: BP. this navigates you to following screen. At this moment, you don't need to input company code or purchasing organization.

When you double click shown BP, BP details are displayed. BP has roles, and depending on the selected role the contents displayed change.

When you select Supplier (Fin. Accounting), company code view can be checked. When you click the button 'Company Code', the company code view for the BP is displayed.

When you select Supplier as BP role, the button 'Purchasing' appears. When you click the button, purchasing organization view for the BP is displayed.

Daily transaction with accounts payable

Entering Vendor Invoices

Let's take a look at daily transaction to enter accounts payable. Example here is, a vendor invoice. Usually, the vendor invoice is seen as following document for purchase order, but there is a case that only the vendor invoice is coming. For example, the case of rent fee payment.

Those vendor invoices entered directly in accounts payable is called as miscellaneous invoice, by the way.

When you enter Tr-Code : FB60, you can enter incoming invoice from vendor. When you use Tr-Code: MIRO, you can create invoice referring predecessor document such as purchase order if existing, but also without it.

The accounts payable entry screen is divided into the following areas:

- Header and vendor data:

Document header and vendor information are maintained in upper part of invoice. - G/L account items:

The G/L line items for the document are entered in bottom part.

When entering an expense item for an operating expense, you must also enter a cost accounting-relevant assignment, such as a cost center or internal order (on screen, just 'Order' is displayed), to tell which cost center or order is related to the entered expenses.

This means that when the item is posted, documents are created in Management Accounting and Financial Accounting.

Recurring entry program

There are cases that you need to post certain financial transaction repeatedly at regular intervals. Posting those transactions every time when it comes the day you need to post that those transaction would be unreasonable.

For those cases, you can use the recurring entry program for postings. With this program, the necessary documents are generated automatically.

To use the recurring entry program, you need to store recurring entry original documents in SAP. Each recurring entry original document contains the date of the first and last postings, the frequency at which posting should be made, and the date of the next planned posting.

At the first time, it would take a little bit effort but after that, the posting would be made automatically.

With Tr-Code: FBD1, the recurring entry original document can be created. The screen and the process is quite similar to the ordinary process of entering financial transaction. In this case, you need to specify the range of date and interval of the document creation so that system can create document in accordance with those information.

When the recurring entry document is created, those information entered at creation can be checked with Tr-Code: FBD3. When you click 'Go to' and click 'Recurring entry data', First run date, Last run date, Interval in month and so on could be seen.

Payment process

When the accounts payable is created, the accounts payable are waiting to be paid. The payment transaction can be carried out either manually or automatically using the payment program.

With Tr-Code: F110, you can use automatic payment program to process payment. In the selection screen, you can choose posting date, and accounts related to the postings, such as vendors.

This payment program can be used for both of incoming and outgoing payments, as you can see that there are 2 corresponding fields in the selection screen, customer and vendor. However, it is more commonly used for outgoing payments.

Payment process has following 5 steps.

- Maintain the parameters.

- Run a payment proposal.

- Check the payment proposal.

- Run payment.

- Print payment media.

In step 1: maintaining the parameters, you use the parameters to define which accounts and items the payment program is to include in the automatic payment run. When parameter is correctly entered, the automatic payment transaction can be saved.

In step 2: the proposal run, all you have to do is to hit the 'Payment' button to run proposal. You can schedule running the program, or start running immediately by checking the 'Start immediately' check mark.

During the proposal running, following process is taken by system.

- Accounts and documents specified in the parameters for due items are checked.

- Items due for payment are grouped.

- Relevant payment methods, house banks, and partner banks are selected.

When payment proposal is created, status for the transaction is updated.

In step 3: checking and editing the payment proposal, This step can be ski[[ed, but you cam check and edit payment proposal if it's necessary.

In the same screen, after the payment proposal is created, there should be button 'Display Proposal'. By clicking the button, you can check the document, and by clicking the 'Edit Proposal', you can edit the proposal.

In step 4: the payment run, payment documents are posted and open items (accounts payable) are cleared. In addition to this, payment media would be prepared.

By clicking the button 'Payment', payment is processed and when it's correctly completed, no longer the proposal could be edited.

In step 5: print payment media, payment media is generated, such as checks, or IDocs for the electronic data interface (EDI).

This is the end of the payment process.

Accounts payable and Material Management

Accounts payable is closely related to material management. It is because material management is a module to handle purchasing activity, and accounts payable is created as a result of purchasing activity.

Organizational units in Material Management

First, let's take a look at organizational unit in material management. the most important object is a plant.

A plant is an operating area or branch within a company, which could be manufacturing site, central delivery warehouse, regional sales office, or corporate headquarter.

A plant must be assigned to a single company code. However, one or more plants can be assigned to the same company code, because there are cases that one company has several manufacturing sites or warehouses.

Material Management handles purchasing activity and inventory management. When material is purchased from vendor, those goods are received at warehouses, here, plant. At the same time, accounts payable is recognized for the company code which is assigned to the plant. This is the brief relationship between accounts payable and material management.

3 way match / 3 step verification

Another thing that needs to be pointed out as connection between accounts payable and material management is 3 way match, or 3 step verification, which is a standard procedure for posting procurement transactions in Materials Management (MM).

This is a process of verification of payment amount referring 3 items, purchase order, goods receipt, and invoice.

- Purchase order:

Purchase order is the first information which has what material is procured, and how much the amount would be. At the moment of purchase order creation, posting in financial accounting is not yet conducted. - Goods receipt:

When goods are received, material document is generated in Material management to update inventory information.

At the same time, posting in financial accounting is made to post value of the goods to the merchandise account as a debit, and the goods receipt/invoice receipt (GR/IR) to the clearing account as a credit in the general ledger. - Invoice verification:

When invoice is received from vendor, we need to post the vendor invoice using invoice verification. (By the way this process needs Tr-Code: MIRO)

This automatically generates a document in FI, which contains the invoice amount that gets posted to the GR/IR account (debit) and the vendor account (credit).

If the amounts entered in this step does not align with purchase order or goods receipt information, system will issue error message and posting would not be possible.

Balance Confirmation

Accounts payable needs to be reconciled for each vendor periodically, for internal control perspective and for appropriate cash management point of view.

In SAP, there is a program to manage balance confirmation request and reply from vendor. When the vendors receive the request for balance confirmation for accounts payable related to them, they will check the balance information and send their replies to the control center audit department, which compares the replies with the reconciliation list and enters the results in the results table.

Tr-Code used here is F.18 (Vendor Balance Confirmation). You can determine vendor as balance confirmation target by selection criteria on screen.

Foreign Currency Valuation

If vendor accounts contains accounts payable in a foreign currency, the amount of those open items need to be translated to the local currency at the company.

The exchange rate would be different at the time of valuation, and requirements, so if it's needed, the valuation would be taken place repeatedly.

When the valuation occurs, posting in either of expense from foreign currency valuation to balance sheet adjustment account, or balance sheet adjustment account to revenue from foreign currency valuation are conducted.

Tr-Code: FAGL_FCV will lead you to the screen for foreign currency valuation. Here, you can specify selection criteria for searching open items in foreign currency.

This program can be executed by test or simulate mode so that you can check the difference caused by exchange rate between the date that the entry was made and the date that this program is executed.

If the tested or simulated results are OK, you can execute the program by "Update Run" mode. This will update the posting.

Summary

This is the end of post to explain accounts payable in SAP. Let's see the summary.

Accounts payable is a liability for company to pay money for vendor. To recognize accounts payable appropriately, vendor master is required.

Financial document to enter accounts payable in vendor account can be made directly with or without referring any predecessor document.

If financial document is created referring purchase order, then 3 way match is taken to check the consistency among purchase order, goods receipt, and invoice.

If continuous entry of accounts payable is planned, you can use recurring entry program.

Payment process has several steps, parameter setting, payment proposal creation and check, payment execution.

Accounts payable needs to be reconciled for each vendor level periodically, and SAP provides program to request this and record the reply from vendor about the balance confirmation.

It was quite good for me to know what was happening in FI after goods are purchased and stored as inventory. I hope this post would be made use of for you.